- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

The Interest Menu allows for the ability to handle interest accrual for tax debts that accrue interest. Not accruing interest means losing funds. A local government can accrue interest within this software it does not have to be done by an internal I.T. group or external vendor or accounting system.

Frequency: The interest accrual process needs to be done monthly. However,if it is missed it can still be done to get up-to-date.

- this menu requires access rights assigned in the User Setup.

- this menu requires access rights assigned in the User Setup.

- create some kind of reminder to execute this monthly to stay current and attempt to collect the highest amount of debts possible.

- create some kind of reminder to execute this monthly to stay current and attempt to collect the highest amount of debts possible.

- if a debt is marked as interest accruing by mistake too much could be taken from their tax refund or lottery winnings.

- if a debt is marked as interest accruing by mistake too much could be taken from their tax refund or lottery winnings.

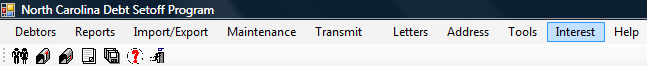

The Interest menu:

There are five functions within Interest:

- Interest Accrual Global Update (frequency: monthly) - the main interest option and must be executed in order to accrue interest. Interest WILL NOT accrue without this.

- Interest Accrual Global Info (frequency: as needed, not a normal option) - this function will retract/undo, the interest that was accrued by executing the Interest Accrual Global Update.

- Interest Accrual Settings -( frequency: as needed, not a normal option) - will set ALL debts with the Account Code of "TAX" as Interest Accruing or set ALL debts, not just "TAX" as NOT interest accruing.

- Base Amount Update ( frequency: as needed, not a normal option) - will make the Base Amount (Debt Principal) the same as the Current Debt Amount.

- Interest Rate Amount - set the rate for the monthly interest rate calculation.

- Interest Accrual Report - prints a report of all debts that had interest accrual generated.